Last week we briefly explained the elements of an ESG report. This week Justin Kale, Co-Founder of Energility, will explain how an energy audit, what we call an Energy Plan, can help an organization understand where they are today with their energy use and connect the dots with where an energy audit helps with planning ESG related improvements.

ESG is not new, but popularity is growing (it has actually been used for almost 2 decades). The acronym for environmental, social, and governance reporting is the latest in a series of Corporate Citizenship, Corporate Sustainability, Corporate Responsibility, and similar reports to enable organizations to present to their stakeholders what “good deeds” are being done on their behalf. However, increasingly organizations are making their steps towards environmental sustainability public, as consumers (in addition to stakeholders) require knowledge of how organizations are working towards lower environmental impact where they spend their money. Even employees and future candidates for employment want to know their company is committed to a sustainable future. The content of an energy audit can be helpful to for-profit organizations trying to figure out ESG for reporting to stakeholders, consumers, and employees. It can be useful for non-profit organizations to use similarly, except their stakeholders tend to be funders of their organization or parishioners of a house of worship.

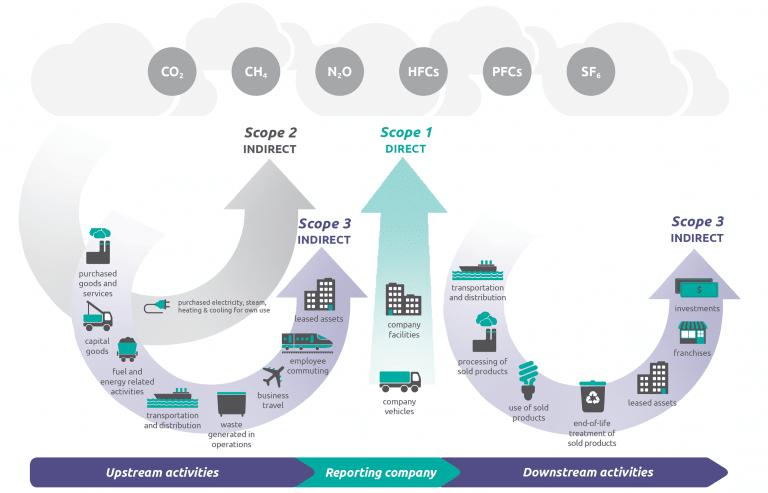

The E is about environmental impact. Greenhouse Gas Protocol has defined 3 types of impact, classified as “scope” of emissions.

Energy audits are the starting point that we typically use for organizations when they ask: how do I lower my energy bills? How do I figure out the benefits of a heating and cooling project? Does it make sense to put solar on my building? However, we’ve also been getting asked: how can an energy audit help me with my ESG planning?

An energy audit also incorporates benchmarking to assess where your organization compares to peers or competitors. The most common energy benchmarking tool is ENERY STAR Portfolio Manager®. With a few building characteristics and recent energy fuel use by source, the tool generates an output in the form of a baseline (here’s where you are today). The baseline metrics typically are energy, cost, and emissions. The energy audit defines the baseline of energy use of all fuels (electric, natural gas, etc.) used on the site and their end use (heating, cooling, lighting, other uses in facilities). The baseline also defines the environmental impact of this building’s operational energy use in terms of greenhouse gases. The greenhouse gas emissions from current operation are quantified by the source of fuels used and the amount used on site. For example, a building could use energy on site where 55% from electricity distributed via the grid, 35% from natural gas distributed from a utility pipeline, and 10% from electricity via on-site solar panels. Each one of those fuel uses has a source energy value: where did it come from?

An energy audit is also going to quantify the low cost actions and capital investment plans for reducing energy use (Scope 1 emissions). The audit also looks at the different building fuel sources and their purchased rates (Scope 2 emissions).

While an energy audit does not address all aspects of emissions from an organization, it is a great assessment of the current environmental impact of real estate assets owned by the organization. A common finding from our due diligence is that commercial and industrial consumers should be engaging an energy professional to help them source the best available rate, the best available purchasing strategy, and incorporating renewable energy as part of the purchase plan for procuring energy for their buildings. This is part of a “belt and suspenders” approach; we see on-site renewable energy increasing in adoption, an affordable option with rising energy prices, increases in financial incentives like tax credits, and need to have a risk management strategy to generate electric on-site. These actions are part of both Scope 2 and 3 emissions.

Lastly, an energy audit can be conducted across any building and facility type. This could be a requirement of large manufacturers to engage their supply chain and build such requirements into purchasing agreements (i.e., conduct an energy audit every 5 years and implement findings with less than 3 year payback). Engaging supply chain and other indirect companies can help them lower their footprint. This is a way to address Scope 3 emissions.

The Energy Plans that Energility delivers for our clients encompasses quick actions to take, plans for development of energy-related projects, and assessment of real estate assets. A good energy audit should help begin your work on ESG or become a building block for planning next steps in your energy management journey towards wherever your goals are taking you.